We have to calculate the real estate tax for a year.

The tax rate is 83.21 mills.

The rate of assessment is 30%.

The market value of the property is $367,500.

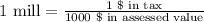

NOTE: a tax rate of 1 mill represents $1 of tax per $1000 of assessed value.

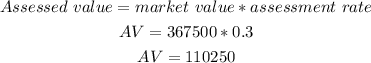

Then, we start by calculating the assessed value of the property.

This will be the market value times the rate of assessment:

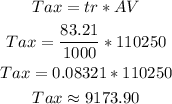

Now, we can calculate the tax as the assessed value times the tax rate.

The tax rate can be expressed as percentage using the meaning for a "mill":

Then, 83.21 mill will represent a tax of $83.21 per thousand dollars of assessed value.

We then can calculate the tax as:

Answer: the real estate tax for a year will be $9,173.90.