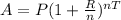

Consider that the principal (P) invested at an annual rate of interest (R) for time (T) compounded as per the number of periods (n), gives an amount (A) of,

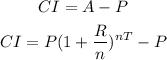

The corresponding interest is given by,

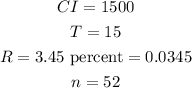

According to the given problem,

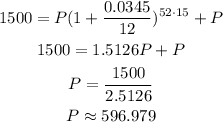

Substitute the values,