Given

Pre-tax income = $1,008,000

net reserve for warranties = $100,400

tax depreciation exceeded book depreciation = $202,000

TarHeel subtracted a dividends received deduction = $ 51,600

Find

TarHeel's accounting effective tax rate

Step-by-step explanation

As we know

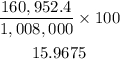

effective tax rate = Tax Liability/Pre-tax income * 100

so , we need to find Tax liability

Tax Liability = Taxable Income * Tax Rate

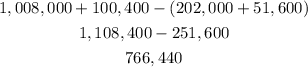

Taxable Income = Pre tax income + Increase in Reserve - (Additional Tax Depreciation + Deduction in the form of Dividend received)

so ,

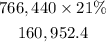

As the tax rate is not mentioned in the question , it has been assumed to be 21% as it will not be possible to attempt the question without the tax rate

Tax Liability =

so,

Effective Tax Rate =

Final Answer

TarHeel's accounting effective tax rate = 16% Approx