Given :-

- A dealer sold a photocopy machine at Rs 4200 with 13% VAT to a retailer.

- The retailer added transportation cost of Rs 250 , profit Rs 300 and local tax Rs 150 and sold to consumer .

- Customer has to pay 13% VAT .

To Find :-

- Amount to be paid by the customer .

Solution :-

Here , according to the question ,

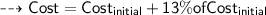

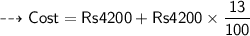

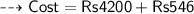

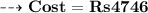

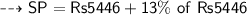

Therefore cost after adding VAT ,

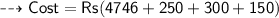

Again the values added by the retailer before selling to customer ,

- Transport = Rs 250

- Profit = Rs 300

- Tax = Rs 150

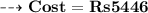

Therefore total cost after adding these ,

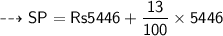

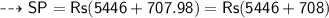

Again Selling price after addition of 13% VAT ,

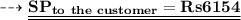

Hence the amount to be paid by the customer is Rs 6154 .