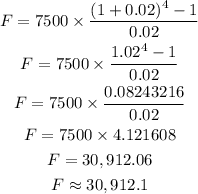

Given data:

PMT = $7,500

Interest rate = 4% or 0.04

Compounded semiannually = twice per year

Time = 2 years

Number of periods in total = 2 years x twice per year = 4 periods

interest rate per period = 0.04/2 = 0.02

The formula in getting the future value of an ordinary annuity is:

where

i = interest rate per period

n = total number of periods

PMT = regular payment

From the given data above, let's substitute those in the formula.

Ther