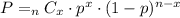

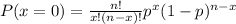

The second part of the problem uses the concept of binomial probability. The formula to compute for the probability is

where nCx is the number of combinations that x will be selected from space n. The probability of success p for a single trial is computed already in part (a). 1-p represents the probability of failure.

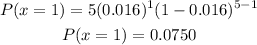

For the probability that exactly one will be audited on five taxpayers, we have n = 5. The probability of success is computed on part (a) as 0.016. The value of nCx, in this case, is 5. We are now set to compute the value of probability for the first part. We have

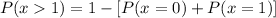

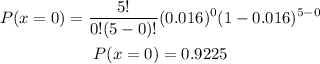

For the probability of x > 1, we will use the formula

where

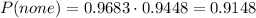

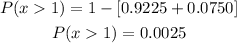

Using the value of n and p above at x = 0, we get

The value of P(x = 1) is already computed above. Solving for P(x > 1), we get

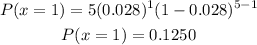

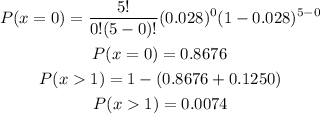

For part (c), we will use the same solving technique applied on part (b) but the probability that we will be using is p = 0.028 since we are dealing with the case for auditing with taxpayers with more than $100,000 income.

For P(x=1), we have

For P(x>1), we have

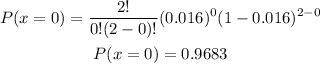

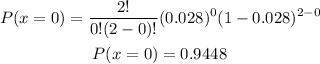

For part (d), we will compute for the value of P(x = 0) for n = 2 for both the taxpayer with less than 100,000 income and the taxpayer with more than 100,000 income. we have

The product of these two probabilities will represent the final answer for the case that no taxpayer will be audited. We have