Answer:

3 roots.

Explanation:

To determine how many roots a polynomial has, you have to look at the term with the highest exponent. That exponent is how many roots the polynomial will have.

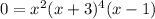

Then, for:

Since this polynomial is factored already equalizing 0, we can see that there are three roots: