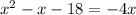

We are given the following equation

We are asked to solve for x by factoring the equation

Let us first simplify the equation

The equation has been simplified and now we can proceed to factor this equation

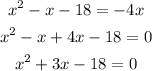

The standard form of a quadratic equation is given by

Comparing the standard form with our equation we see that

A = 1

B = 3

C = -18

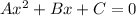

Now to factor the equation, we need to think about two numbers such that

When we multiply them, we get A×C = -18

When we add them, we get B = 3

Can you think of such two numbers?

How about 6 and -3?

When we multiply them we get, 6×-3 = -18 (satisfied)

When we add them together we get, 6 +(-3) = 3 (satisfied)

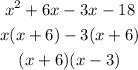

So, our equation becomes

The above equation is the factorized equation.

Now let us solve for x

x + 6 = 0

x = -6

x - 3 = 0

x = 3

Therefore, the solutions of the given quadratic equation are x = (-6, 3)