ANSWER

784 cheetahs

Step-by-step explanation

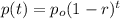

The population of cheetahs is given by an exponential decrease,

Where r is the decrease rate and p₀ is the initial population.

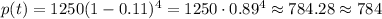

In this problem, the initial population is 1250 cheetahs, the decrease rate is 0.11 and we have to find the population of cheetahs after t = 4 years,

Hence, there will be 784 cheetahs after 4 years.