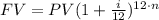

To answer this question, we need to take into account the next formula:

Where,

FV is the Future Value.

PV is the Present Value.

i is the interest rate.

n = interest periods

The number of compounded periods, in this case, is 12 (compounded monthly).

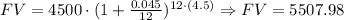

Then, we have that:

PV = $4500

i = 4.5 = (4.5/100) = 0.045

And we want to know the value for FV after 4.5 years.

Then, applying the formula, we have:

Then, the value of the account when the customer takes the money at the end of the 4.5 years is $5507.98.