We need to position the four points so they all are on the graph of an exponential function.

As an example of an exponential function, let's use the following function:

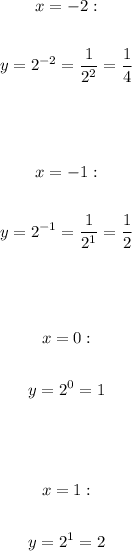

Now, to find where the points should be located, let's choose some values of x and calculate the corresponding values of y:

Therefore the points should be located at (-2, 1/4), (-1, 1/2), (0, 1), and (1, 2).