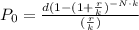

The payout annuity formula is the following:

Where:

Po is starting amount in the account

d is the regular withdrawal

r is the annual interest rate (in decimal form)

k is the number of compounding periods in one year

N is the number of years we plan to take withdrawals.

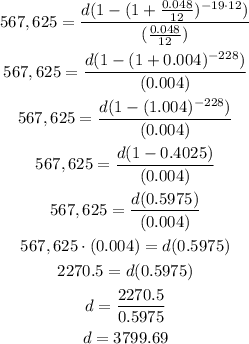

The given information is:

Po=$567,625

r=4.8%/100%=0.048

k=12 since we are withdrawing monthly

N=19 years.

By replacing this information in the formula, we can solve for d as follows:

Answer: you will be able to pull out each month $3799.69 for 19 years