2P = 39 cm

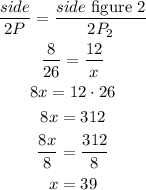

1) Since the first rectangle has a width of 8 cm and the perimeter (2P) of 26, and considering the side lengths we can write the following ratios:

Note that we can state this relationship between two similar geometric figures. The side over the Perimeter = corresponding side/ Respective Perimeter.

2) Hence, the answer is 39 cm