Step-by-step explanation

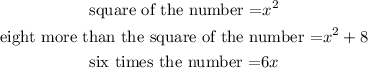

Given that eight more than the square of a number is the same as six times the number.

Let the number be x

Therefore

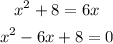

Hence, the equation is interpreted as;

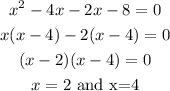

We can therefore solve using the factorization method.

-4 and -2 are the numbers that would serve for the sum and products of factors.

Answer: 2 and 4