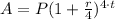

the Principal P=4000 dollars. The first option pay 1.8% quaterly. In this case, the compounden interest

formula is

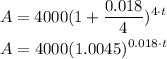

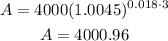

by substituying P=4000 and r=0.018, we have

hence, in t=3 years, Samuel will have

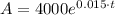

Now, option 2 will pay 1.5 interest, compounded continuously. In this case, the formula is

By substituying P=4000 and r=0.015 and t=3, we have