Given that John puts down 21% on the $2065 TV, this implies that the initial amount paid on the TV is

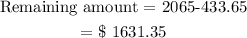

Thus, the remaining amount to be paid on the TV is

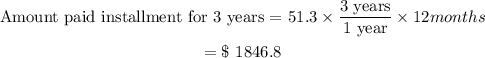

Given that the remaining balance is to be paid monthly using the installment plan at $51.3 for 3 years, this implies that

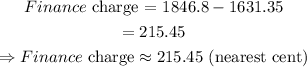

The finance charge on the TV is evaluated as the extra cost incurred when installmental payment is made as compared to outright payment.

In simple terms, it is the difference between the original remaining amount to be paid and the total amount paid in installment.

Thus,

Hence, the finance charge on the TV is 215.45 (nearest cent).