Solution:

Given:

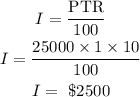

To get the interest lent to his sister at 10% simple interest;

Using the simple interest formula;

Hence, the sister will pay back $2500 interest for the money lent.

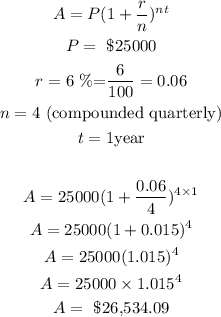

To get the interest gotten if he invests in a retirement plan at 6% compounded quarterly for a year;

Using the compound interest formula;

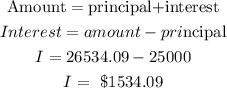

To get the interest made from the retirement plan,

Hence, the interest made from the retirement plan compounded quarterly for a year is $1534.09

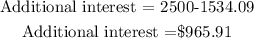

Thus, the additional interest the simple interest loan to his sister will generate is;

Therefore, the additional interest the simple interest loan to his sister will generate is $965.91