This is an example of a Payout Annuity problem.

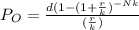

The Payout Annuity formula is given to be:

where

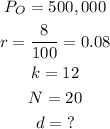

P0 is the balance in the account at the beginning

d is the regular withdrawal

r is the annual interest rate

k is the number of compounding periods in one year

N is the number of years we plan to take withdrawals.

From the question, we have the following parameters:

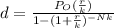

Since we are to find the value of d, we can adjust the formula such that d is the subject:

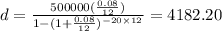

We can now substitute the values and solve as shown below:

Therefore, you will be able to pull out $4,182.20 monthly.