The first step is to calculate the payment, that is going to be equal for each month.

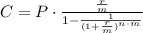

To do that, we apply the annuity equation:

Where C is the total monthly payment, P is the principal (106,000), n is the number of years (20), m is the number of superiods (for monthly payments, is equal to 12) and r is the annual interest rate (6% or 0.06).

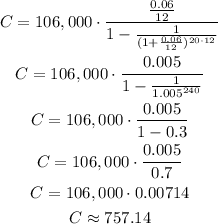

Then, we can calculate:

The monthly payment is $757.14.

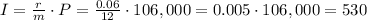

We can calculate the amount of interest that is paid by applying the simple interest formula:

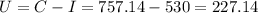

The interest payment is $530, so the difference between the total payment and the interest payment mst be the principal payment U:

This principal payment is deducted from the principal, so the balance of principal becomes (after the first payment):

Answer:

a) Total Payment: $757.14

b) Interest Payment: $530.00

c) Principal Payment: $227.14

d) Balance of Principal: $105,772.86