Answer:

Step-by-step explanation:

Here, we want to answer questions as regards a mortgage payment plan

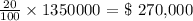

a) We want to calculate the amount of required down payment

From the question, we are told that she is making a 20% down payment

Mathematically, we have this as follows:

b) Here, we want to calculate the monthly principal and interest payment

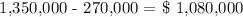

Since she has paid 270,000 as down payment, what is required as the loan would be as follows:

It will be the difference between the mortgage value and the down payment

Mathematically, we have this as follows:

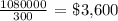

Now, she has to pay this value over a 25 year period

Mathematically, we know that there are 12 months in a year

For a period of 25 years, the number of months will be 25 * 12 = 300

Now,what she is required to pay monthly without interest would be the division of the loan by the principal

We have this as:

Finally, we need to factor in the interest payment

We can get this by actually using the interest rate

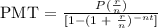

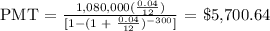

We can get the monthly payment value with interest using the formua below:

Where PMT is the monthly payment with interest which we want to calculate

P is the principal which is the house value less the down payment which is $1,080,000

r is the interest rate which is 4% = 4/100 = 0.04

n is the number of times of compounding per year. Since it is a monthly payment, and there are 12 months in a year, this value is equal to 12

t is the number of years which is 25 years

nt is 25 * 12 = 300

Now, we proceed to substitute these values into the formula written above

Mathematically, we have this as:

The amount to pay monthly is thus $5,700.64

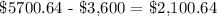

To calculate the monthly interest, we have to subtract the value paid without interest consideration and the value to pay when we consider interest

That would be:

This mean she is to pay $3,600 principal payment and $2,100.64 interest payment (a total of $5,700.64 per month for 25 years)