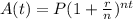

The formula for compound interest is:

Where:

A is the amount in the account after t years.

P is the amount initially invested.

r is the rate of compounding per year, in decimal.

n is the number of times compounded in a year.

t is the number of years since the initial investment.

The problem tells us:

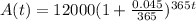

The initial amount is P = 12000

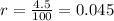

The annual compounding rate is 4.5%, to convert to decimal, we divide by 100:

Since the amount is compounded daily, it's compounded 365 times a year. Thus, n = 365

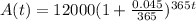

Now we can write:

Which is option 3

Thus, the correct answer is option 3: