Answer:

$843.14

Explanations:

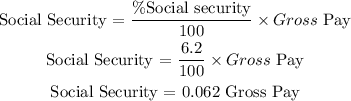

% Social security = 6.2%

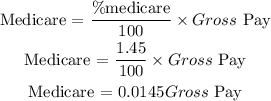

% Medicare = 1.45%

Note that:

The combined medicare and social security deduction is $64.50

That is:

Medicare + Social Security = 64.50

0.0145GrossPay + 0.062GrossPay = 64.50

0.0765GrossPay = 64.50

GrossPay = 64.50 / 0.0765

GrossPay = $843.14