Answer:

• The amount put in the bank = $1,500

• The amount used to buy bond = $500

,

• The amount used to buy the certificate of deposit =$8000

Step-by-step explanation:

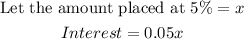

Bank (5%)

Bonds (6%)

1/3 the amount placed in the bank was used to buy bonds

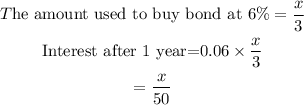

Certificate of Deposit (8%)

If the total of the investments is $10,000, the balance of the funds will be:

![undefined]()

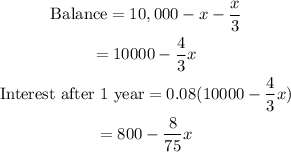

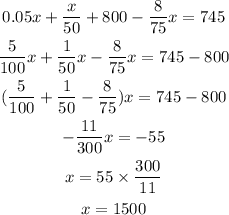

The first year, the investments bring a return of $745. Therefore, we sum up all the interests:

Thus:

• The amount put in the bank = $1,500

,

• The amount used to buy bond = 1500/3 = $500

,

• The amount used to buy certificate of deposit = 10,000-2000=$8000