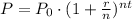

In order to calculate the final value of the investment, we can use the following equation:

Where P is the final value, P0 is the initial value, r is the annual rate, t is the amount of time and n is a factor relative to the period of compound.

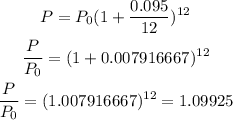

For the first investment, the rate is 9.5 compounded monthly (a year has 12 months, so we use n = 12). So for one year, we have that:

The increase in the initial investment is 0.0992 times, that is, 9.92%.

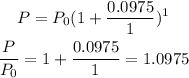

For the second investment, the rate is 9.75% compounded annually (so n = 1), so we have:

The increase in the initial investment is 0.0975 times, that is, 9.75%.

The first investment has a greater increase in one year, so the first investment is better.