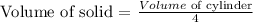

The given diagram;

The radius of the cylinder = 4in

Height of the cylinder = 10in

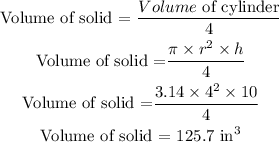

Since, the diagram is the 1/4 part of the cylinder. so the volume of this given solid is equal to the volume of the full cylinder divide by 4.

The expression for the volume of cylinder πr²h.

Substitute r = 4, h = 10;

Answer : D) 125.7in³