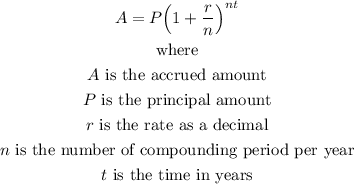

Recall the formula for compound interest

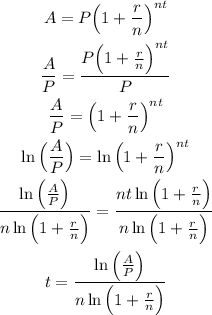

Using the formula, rearrange the equation and solve in terms of time t

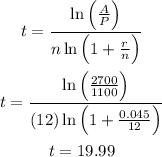

Substitute the given values and we get

A = $2700, P = $1100, n = 12 (12 months in a year), r = 0.045 (from 4.5%)

Rounding the answer to the nearest tenth, the time it takes is 20 years.