hello

to solve this problem, we need to work out how much he earns weekly, and then work it up to annually

step 1

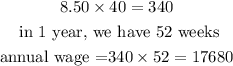

calculate the weekly wage into annual wage

he earns $8.50/h and works 40 hours in a week

weekly wage =

Raggie earns $17,680 annually

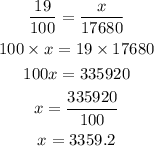

he gets fridge benefit of 19% of his annual wage

we need to find 19% of $17,680

he gets additional $3359.2 as fridge allowance

we can add up the total to know his total annual wage

total annual wage = wage + allowance = $17680 + $3359.5 = $21,039.2

his annual expense

commuting = $419

uniforms = $560

parking = $430

total expense = $419 + $560 + $430 = $1,409

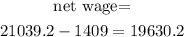

net wage = gross wage - expenses

net wage =

Reggie's annual wage after expenses = $19630.2