Answer

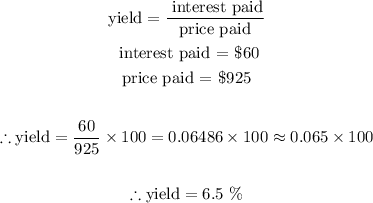

The yield is 6.5%

Problem Statement

The question tells us to calculate the yield on a corporate bond with $1000 face value bought with a discount at $925 with 6% fixed interest for the duration of the bond

Method

To solve the question, we need to follow these steps:

1. Calculate the interest paid:

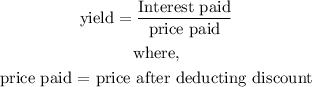

2. Apply the yield formula given:

Implementation

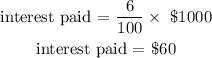

1. Calculate the Interest paid:

This is given by:

2. Apply the yield formula:

Final Answer

The yield is 6.5%