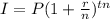

The compound interest formula is given by:

where,

P: principal investment = $400

r: interest rate = 3% = 0.03

n: times at year = 4 quarterly

t: years = 0, 5 , 10, 15, 20

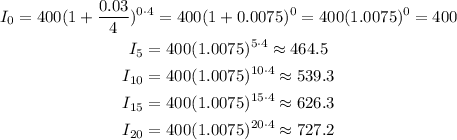

Replace the previous values of the parameters into the formula for I and simplify for each value of t:

Hence, the amounts for t=0, 5, 10, 15 and 20 years are, respectivelly:

$400

$464.5

$539.3

$626.3

$727.2