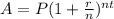

The rule of the compounded interest is

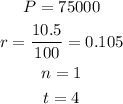

P is the initial amount

r is the ratio in decimal

n is the number of the periods in a year

t is the time in years

Since she will invest $75,000 for 4 years at 10.5% compounded annually, then

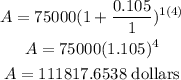

Substitute them in the rule above

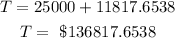

We will add it to the amount she pays now to find the total amount she must pay

She needs now $136,817.6538