First, we will start defining the P/E ratio, which is the Price to Earnings ratio, and its formula is given by

Or briefly, Value over Earnings. In this problem, we have the Value of the Share, when it closed, and the P/E ratio; as such, we will be using the above formula for obtaining the earnings per share.

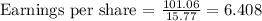

We used the data given in the question. Now, we will clear the Earning per Share:

We get then, that the earnings per share were of $6.408.