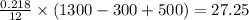

Given that the credit card has an APR of 21.8%=0.218.

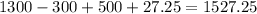

The previous balance in the first month is $1300. The payment is $300 and the purchase is equal to $500.

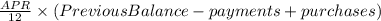

now, we need to find the finance charges by the following formula:

Substitute the given values in the formula:

now, the new balance for the first month will be equal to Previous balance-payments+purchases+finance charges

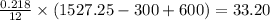

the same calculation goes for the second month. the previous balance for second month is $1527.25. The payment is $300 and the purchase is equal to $600.

The finance charges for the second will be:

So, the new balance for the second month will be

Now, you can fill the table your self.