We need to find which percentage of her total income that she spends, per month. Remember that "savings" is not a spent.

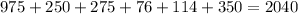

Her total monthly spending, in dollars, is:

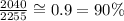

And her total monthly income, in dollars, is 2255.

Thus, the percentage of the income that she spends is given by:

Therefore, since her spending corresponds to approximately 90% of her income, which is more than 20%, then she is in credit overload.