Given data:

The given table is shown.

The given expression is,

Substitute 0 for x and 20080 for y in the above expression.

Substitute 20080 for a in the given expression.

Substitute 1 for x and 20582 for y in the above expression.

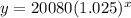

Substitute 1.025 for b in the given standard expression.

Thus, the exponential expression is y=20080(1.025)^x.