Given:

Caps are available with a team name, mascot, or logo. They are either fitted or adjustable. The colors are either red or blue. All combinations are given.

Required:

Find the probability of getting a red cap with the team logo.

Step-by-step explanation:

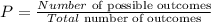

The probability of an event is given by the formula:

The total number of caps = 12

The possible number of the red caps with the team logo = 2

The probability of getting a red cap with the team logo:

Final Answer:

The probability of getting a red cap with the team logo is 1/6.