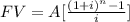

The future value of ordinary annuity is given by the formula:

Where

A = annuity cash flow,

i = interest rate, and

n = number of payments.

The future value of annuity measures the value of the series of the recurring payments at a given point of time in future at a specified interest rate.

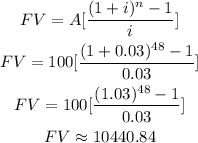

We are given,

A = 100

i = 0.03

n = 4 year x 12 months = 48

Substituting the values, we get:

Answer$10, 440.84