Let's begin by listing out the information given to us:

Guitar price (P) = $670, discount (d) = 10%, sales tax (s) = 8%

It is bought on a one year installment plan; 15% of price upfront + taxes

a.

The discount is 10%

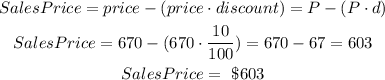

The discounted price is given by the product of the guitar price by dicount =

discount = $670 & 10% = 670 * 0.01 = $67

b.

The sales price is given by the difference between the guitar price minus the discount