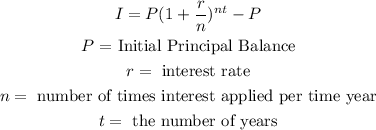

The required formula to calculate the interest is given by is given by:

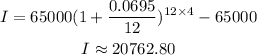

Convert 6.95% to decimal:

Substitute n=12, t=4, P = 65000, and r = 0.0695 into the equation:

Therefore, the interest paid on the first option is approximately $20762.80

Using a similar procedure, it is found that the interest paid on the second option is approximately $20201.74

Therefore, the better deal is the second option and the interest paid is $20201.74