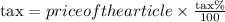

When we know the tax rate of an article (tax%) we can calculate the costs by taxes of that article like this:

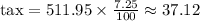

In this case, the price of our article is $511.95 and the tax rate is 7.25%, replacing in the formula above we find the cost associated with the tax, like this:

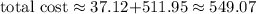

And the total cost, would be the sum of the listed price and the tax cost:

Then, the total cost is $549.07