Answer:

Account 2 is better because the profit is $41.40, about $2.07 more than the profit for Account 1.

Explanation:

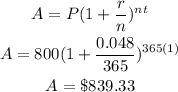

For account 1:

Principal, P = $800

Time, t = 1 year

Number of times interest is compounded per year, n = 365

Interest rate, r = 4.8% = 4.8/100

r = 0.048

Amount in account 1 after 1 year is:

The interest = $839.33 - $800

The interest on account 1 = $39.33

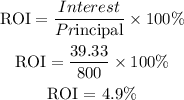

ROI on account 1 = 4.9%

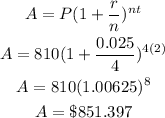

For account 2:

Principal, P = $810

Time, t = 2 year

Number of times interest is compounded per year, n = 4

Interest rate, r = 2.5% = 2.5/100

r = 0.025

Amount in account 1 after 1 year is:

The interest = Amount - Principal

The interest = $851.397 - 810

The interest(Profit) on account 2 = $41.397

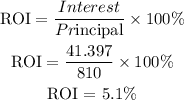

ROI on account 2 = 5.1%

Account 2 is better because the profit is $41.40, about $2.07 more than the profit for Account 1.