Remember that

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is the Number of Time Periods

n is the number of times interest is compounded per year

in this problem we have

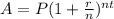

Part 1

P=$40,000

r=3.5%=3.5/100=0.035

n=52 (in one year there are 52 weeks)

t=6 years

substitute

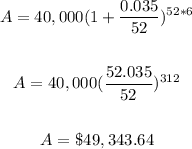

Part 2

we have

P=$40,000

r=3.2%=3.2/100=0.032

n=365 (in one year there are 365 days)

t= 6 years

substitute

therefore

The answer is

The account that pays 3.5% compounded weekly