We will investigate the application of taxes on receipts.

We are given that a sales tax rate ( r ) is applied on all the customer receipt purchase. The sales tax applied on the bill is:

The value of the receipt-purchase ( p ) is given as follows:

We will first determine the sales tax amount ( s ) applied on the purchase receipt ( p ) by considering the applicable tax rate ( r ) as follows:

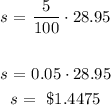

We will use the above relation to determine the sales tax ( s ) amount:

The sales tax amount ( s ) is the extra amount that a customer has to pay over the value of the purchased items.

The total amount that a customer pays at any retail or receipt has the following costs:

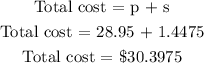

We will use the above relation to determine the total cost as follows:

Therefore, the answer is: