We have a loan with a principal of $12,651.

It is paid in 8 monthly payments.

The annual rate of interest is 7.5%.

We then have to calculate the amount of each monthly payment.

This can be calculated using the annuity formula with subperiods.

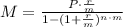

The formula is:

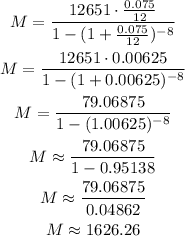

For this problem we have a principal P = 12,651, an interest rate r = 0.075, the subperiods are months so m = 12, and the number of payments is n*m = 8.

We can replace and solve as:

Answer: the monthly payment in each check was $1626.26.