The tip is $1.80.

It is 20% of the after tax cost.

The tax is 6%.

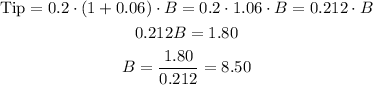

We can write the tip amount in function of the bill B as:

The original bill before tax is $8.50.

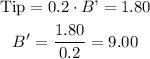

If we need to calculate the bill after tax (that is, bill + tax), we don't need to know that the tax is 6%, because we would calculate the bill after tax B' as:

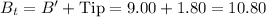

If we add the tip, the total bill Bt is:

Answer:

The information that is not needed to calculate the bill after tax is C. the tax was 6%.

The total bill after tax and tip is $10.80.