In this case, we'll have to carry out several steps to find the solution.

Step 01:

Data:

total price = $280000

rate = 7.2%

time = 30 years

Step 02:

interest compounded monthly

14% down = $280000 * 0.14 = $39200

P = $280000 - $39200 = $240800

A = P (1 + r/n) ^ nt

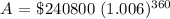

A = $240800 (1 + 0.072/12) ^ 12*30

A = $2074564.24 ==> total amount

I = $2074564.24 / (12*30) = $5762.68 ===> mensual amount

Step 03:

Mensual amount = $2400

$2074564.24 / $2400 = 864.4

865 payments

The answer is:

A. $5762.68

B. $2074564.24

C. 865 payments