We will have the following:

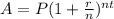

*First: We have the expression:

Here "A" is the final amount, "P" is the intitial principal balance, "r" is the interest rate, "n" is the number of times interest applied per time period & "t" is the number of time periods.

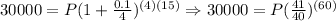

*Second: We determine the values given:

A = $30 000

r = 0.1

n = 4

t = 15

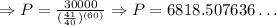

*Third: We replace in the expression and solve for P:

So, Ann and Tom would need to deposit approximately $6818.5 at the begining.