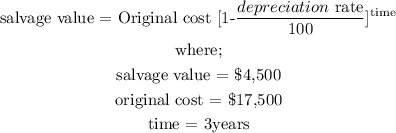

The formula to be used for calculating depreciation is given by;

Substituting all these in the formula above and making the rate the subject of the formula, we have

![\begin{gathered} 4500=17500\lbrack1-(r)/(100)\rbrack^3 \\ (4500)/(17500)=\lbrack1-(r)/(100)\rbrack^3 \\ 0.2571=\lbrack1-(r)/(100)\rbrack^3 \\ \sqrt[3]{0.2571}=\lbrack1-(r)/(100)\rbrack \\ 0.6359=\lbrack1-(r)/(100)\rbrack \\ (r)/(100)=1-0.6359 \\ (r)/(100)=0.3641 \\ \text{cross multiplying, we have} \\ r=0.3641*100 \\ r=36.41\text{ \%} \end{gathered}](https://img.qammunity.org/2023/formulas/mathematics/high-school/61zy8o3aanwrgrc4lla9k81dhpmdv2r35g.png)

Hence, the rate of depreciation to the nearest whole percent is 36%

Therefore, none of the choices given are correct.