Step-by-step explanation

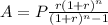

to find the regular monthly payment amount we need to use the formula:

so

Step 1

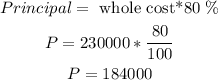

find the principal,

if you make a 20% down , it means the rest is 80 %, so the Principal will be 80 % of the total

Step 2

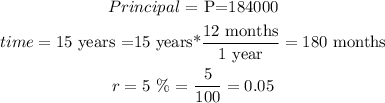

now, find the regular monthly payments amount

a) let

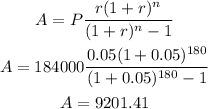

b) replace

so, the answer is 9201.41