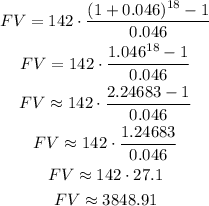

We have to calculate the future value (FV) after n = 18 years of an investment of $142 each year, with a rate of interest of 4.6% (r = 0.046) compounded annually.

We can calculate the future value of an annuity like this as:

Replacing and calculating, we get:

Answer: She will have $3848.91 in her account.