a)

Since the bank pays 5% each year, then the balance after one year will be 105% of the original balance.

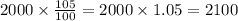

To find the balance after one year, calculate what is 105% of 2000 equal to by multiplying 2000 times 105/100:

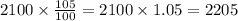

The same process is repeated the next year, where the balance will be equal to 105% of 2100:

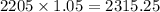

And so on. To find the balance on the third year, multiply 2205 by 1.05:

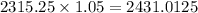

The balance on the fourth year will be:

And in the fifth year:

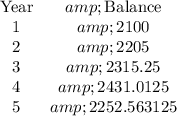

Therefore, the table will include the following data:

B)

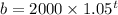

Since each year the balance gets multiplied by 1.05, then after t years the balance would increase by a factor of 1.05^t.

Since at year 0 the balance was $2000, then the equation that models the balance b after t years is:

C)

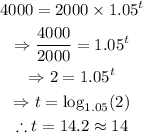

To find how many years it will take for the original deposit to double in value, set b=4000 and solve for t:

It will take approximately 14 years for the balance to double.

D)

If the interest rate was 10%, then each year the balance would increase by a factor of 110/100, which is equal to 1.1.

Then, the model for the balance as a function of time would be:

And the time that it would take for the balance to double would be:

Then, it would take approximately 7 years for the balance to double if the interest rate was 10% instead of 5%.